That is one of the most common topics that gets discussed in many social gatherings that get into a conversation on achieving that evasive goal of financial freedom. I am not going to preach any one way to achieve that but I will attempt to lay down some facts and show a comparison in terms of numbers.

Stock Market Performance

One of the most commonly traded indexes in the stock market is the S&P 500 and it is considered a good indicator of investment returns in the stock market. Over the past 50 years the S&P 500 has appreciated at an annualized rate of about 10% and it would be reasonable to expect such a return in the stock market over long periods of time.

Real Estate Performance

Residential real estate has appreciated over the years at an annualized rate of about 3% on average. In certain markets the appreciation has been higher than that, but we will use 3% annual appreciation for the purpose of this discussion.

The Comparison

The comparison of the two investments is best explained using an example. Consider you have $20,00 to invest and you have two options – real estate or the stock market.

We will make a few additional assumptions regarding the real estate investment:

Purchase Price: $100,000

Down Payment: $20,000

Mortgage Principal: $80,000

Mortgage Interest: 4%

Mortgage Term: 30 years

Monthly Mortgage Payment: $382

In addition, we will make an assumption that the rent you charge for the property covers all your expenses on the property – mortgage payment, property taxes, insurance, and maintenance.

Now let us compute the following for the next 30 years:

Property Value: The current value of the property at the end of any year based on the 3% appreciation.

Mortgage Balance: The balance of the mortgage you owe to the lender at the end of each year – note that the rent you are collecting is helping pay the mortgage interest and a portion of your mortgage principal.

Equity in Property: This is the portion of the home you own which is computed as (Property Value – Mortgage Balance). In other words, this is the amount you will get in hand if you sell the property.

Profit On Sale: Note that you put down $20,000 to buy the property and all other costs of holding on to the property is covered by the rent you are collecting. So, your total investment is $20,000. So, the Profit on Sale is computed as (Equity in Property – Down Payment).

Equity in Stocks: As discussed above an investment in the stock market is expected to grow at the rate of 10% per year and compounded every year. Equity in Stocks is the value of your stock market investment at the end of any year.

Stock Market Profit: This is net profit you will retain if you sold the stocks and it is computed as (Equity in Stocks – Initial Investment)

The table below shows you a computation of the above indicators for a span of 30 years.

|

Year |

Property Value |

Mortgage Balance |

Equity in Property |

Profit on Sale |

Equity in Stocks |

Stock Market Profit |

|

|

1 |

$103,000 |

$78,591 |

$24,409 |

$4,409 |

$22,000 |

$2,000 |

|

|

2 |

$106,090 |

$77,125 |

$28,965 |

$8,965 |

$24,200 |

$4,200 |

|

|

3 |

$109,273 |

$75,599 |

$33,674 |

$13,674 |

$26,620 |

$6,620 |

|

|

4 |

$112,551 |

$74,011 |

$38,540 |

$18,540 |

$29,282 |

$9,282 |

|

|

5 |

$115,927 |

$72,358 |

$43,569 |

$23,569 |

$32,210 |

$12,210 |

|

|

6 |

$119,405 |

$70,638 |

$48,767 |

$28,767 |

$35,431 |

$15,431 |

|

|

7 |

$122,987 |

$68,848 |

$54,140 |

$34,140 |

$38,974 |

$18,974 |

|

|

8 |

$126,677 |

$66,984 |

$59,693 |

$39,693 |

$42,872 |

$22,872 |

|

|

9 |

$130,477 |

$65,045 |

$65,432 |

$45,432 |

$47,159 |

$27,159 |

|

|

10 |

$134,392 |

$63,027 |

$71,364 |

$51,364 |

$51,875 |

$31,875 |

|

|

11 |

$138,423 |

$60,927 |

$77,497 |

$57,497 |

$57,062 |

$37,062 |

|

|

12 |

$142,576 |

$58,741 |

$83,835 |

$63,835 |

$62,769 |

$42,769 |

|

|

13 |

$146,853 |

$56,466 |

$90,387 |

$70,387 |

$69,045 |

$49,045 |

|

|

14 |

$151,259 |

$54,098 |

$97,161 |

$77,161 |

$75,950 |

$55,950 |

|

|

15 |

$155,797 |

$51,634 |

$104,163 |

$84,163 |

$83,545 |

$63,545 |

|

|

16 |

$160,471 |

$49,070 |

$111,401 |

$91,401 |

$91,899 |

$71,899 |

|

|

17 |

$165,285 |

$46,401 |

$118,884 |

$98,884 |

$101,089 |

$81,089 |

|

|

18 |

$170,243 |

$43,623 |

$126,620 |

$106,620 |

$111,198 |

$91,198 |

|

|

19 |

$175,351 |

$40,732 |

$134,618 |

$114,618 |

$122,318 |

$102,318 |

|

|

20 |

$180,611 |

$37,724 |

$142,888 |

$122,888 |

$134,550 |

$114,550 |

|

|

21 |

$186,029 |

$34,592 |

$151,437 |

$131,437 |

$148,005 |

$128,005 |

|

|

22 |

$191,610 |

$31,333 |

$160,277 |

$140,277 |

$162,805 |

$142,805 |

|

|

23 |

$197,359 |

$27,942 |

$169,417 |

$149,417 |

$179,086 |

$159,086 |

|

|

24 |

$203,279 |

$24,412 |

$178,867 |

$158,867 |

$196,995 |

$176,995 |

|

|

25 |

$209,378 |

$20,739 |

$188,639 |

$168,639 |

$216,694 |

$196,694 |

|

|

26 |

$215,659 |

$16,915 |

$198,744 |

$178,744 |

$238,364 |

$218,364 |

|

|

27 |

$222,129 |

$12,936 |

$209,193 |

$189,193 |

$262,200 |

$242,200 |

|

|

28 |

$228,793 |

$8,795 |

$219,998 |

$199,998 |

$288,420 |

$268,420 |

|

|

29 |

$235,657 |

$4,485 |

$231,171 |

$211,171 |

$317,262 |

$297,262 |

|

|

30 |

$242,726 |

$0 |

$242,726 |

$222,726 |

$348,988 |

$328,988 |

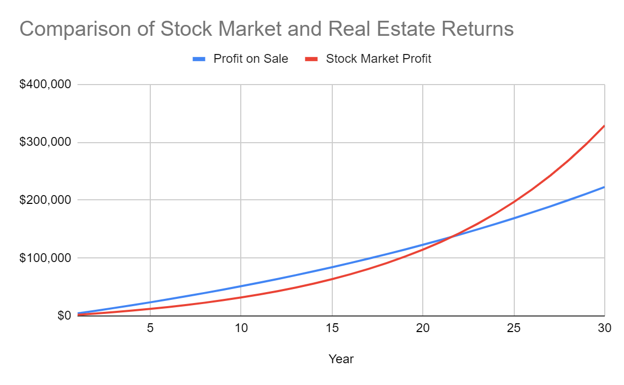

Please take note of what happens between years 21 and 22 in the above table. You will notice that the return from the Stock Market overtakes the return from the real estate investment. The same is shown in the graph below – the point where the Stock Market Profit line (red line) cuts the Profit on Sale line (blue line)

So, you can see that in this case the real estate investment does better than the stock market investment for approximately the first 20 years but after the 22nd year the stock market investment grows rapidly. As a result your investment horizon would determine the type of investment you would want to make.

Note that for simplicity we have not covered a few items in this calculation which could further influence your investment.

-

Any real estate transaction involves certain upfront costs at the time of closing. As a buyer you would have to pay tax escrows, documentation fee, title search and insurance, and settlement charges. This would increase your upfront investment a little more than $20,000 in the above example.

-

There are additional tax benefits in a real estate investment that are not available in a stock market investment. Here are a few:

-

If you have positive cash flow on an annual basis because you collect more rent than your expenses: first of all that will improve your overall net profit from the real estate investment, but in addition, that a good portion of that additional income will not be taxable due the depreciation deductions you are eligible for on the real estate.

For example, consider that you earned an additional $2000 per year of additional income from the property. Your property is eligible for an annual depreciation deduction of $100,000 divided by 29.5 = $3,390. As a result you would not pay any tax on the $2000 income. -

If you do decide to sell the property, you can avoid the tax on the Profit on Sale if you are able reinvest that amount in another comparable property within a span of 6 months. This part of the tax law is commonly referred to as the 1031 exchange.

On the other hand any stock market profit will be taxed at the rate of capital gains tax – 15% – if you retained it for at least 2 years.

-

-

Any small changes to the annual appreciation of the real estate can have large effects on your investment returns. For example, in the above scenario if the property appreciation is 4% instead of 3% the real estate investment will continue to provide a higher return till the 28th year.

In summary, the decision between a real estate investment and stock market investment would largely depend on your investment horizon and local expected value appreciation in your property.

Latest Blogs

AVMs to custom CMAs: A Comprehensive and Integrated approach to Client Engagement

Real estate technology has experienced and continues on a journey of massive transformation driven by data, artificial intelligence, and computer…

Read more

Investors in Real Estate: An Opportunity for the Local Agent

The rental market has grown rapidly since the pandemic and rental prices are nearly 30% higher than they were before…

Read more

Building long-term client relationships with “Claim My Home”

The real estate industry is inherently built on relationships, and successful real estate agents and brokers understand the importance of…

Read more